Have you ever wondered what it would be like to get a letter from a lawyer saying that you’ve just inherited property in the quaint seaside town of Oak Bluffs on Martha’s Vineyard? Well, that’s just what happened to us about 25 years ago.

In January 2000, my mom got a letter from her cousin Margaret Fisher, saying that she had gotten a letter from a Boston law firm informing her that she was an heir to property on Martha’s Vineyard in Massachusetts. Apparently, their great-grand uncle, Truman J. Ellinwood had owned a lot of property on Martha’s Vineyard, but part of his estate was never settled after his death in 1921.

The letter stated, “I represent The Town of Oak Bluffs, Massachusetts, in a tax lien foreclosure case currently before the Land Court in Boston involving property which is owned by the heirs of Truman Ellenwood. The land court requires that legal notice be sent to all interested parties or their heirs before proceeding.”

Our family’s connection to this inheritance was through James A. Stone, my great-grand father. He died in 1947, and his spouse and children had also passed away. So, my mom and her siblings, cousins, nieces and nephews, and other distant relatives were the only living heirs to this property.

However, there was a hitch.

The property was being foreclosed for failure to pay taxes. In other words, if we wanted the property someone had to pay the back taxes. But before anyone could do that, I decided to do some research.

Who Was Truman J. Ellinwood?

Truman was an educator, stenographer, and author. He was one of the founders, an officer, and teacher at the Martha’s Vineyard Summer Institute, and was also the owner and manager of a settlement of summer cottages in Ellinwood Heights.

And notably, for almost 30 years Truman was the private stenographer to Henry Ward Beecher who was “The Most Famous Man in America” according to the author Debby Applegate. LINK to book

Truman died on June 29, 1921, in Massachusetts at the impressive age of 91 and was buried in Oak Bluffs, Massachusetts. At the time of his death, he owned considerable property in the Town of Oak Bluffs, including a settlement of summer cottages in Ellinwood Heights.

However, Truman did not have any surviving children or grandchildren. His will stated “That when my estate is otherwise fully settled, they divide the residue of the proceeds of all property belonging to me…equally between Ira O. Ellinwood, Mina E. Porter, the heirs of Pamela C. Stone (my 2x-great grandmother), and the heirs of Eunice C. Denio.”

But for some unknown reason, one property in the Town of Oak Bluffs was never passed on to his heirs. And then 80 years later, long after the original heirs passed away, his their descendants would learn of their potential inheritance.

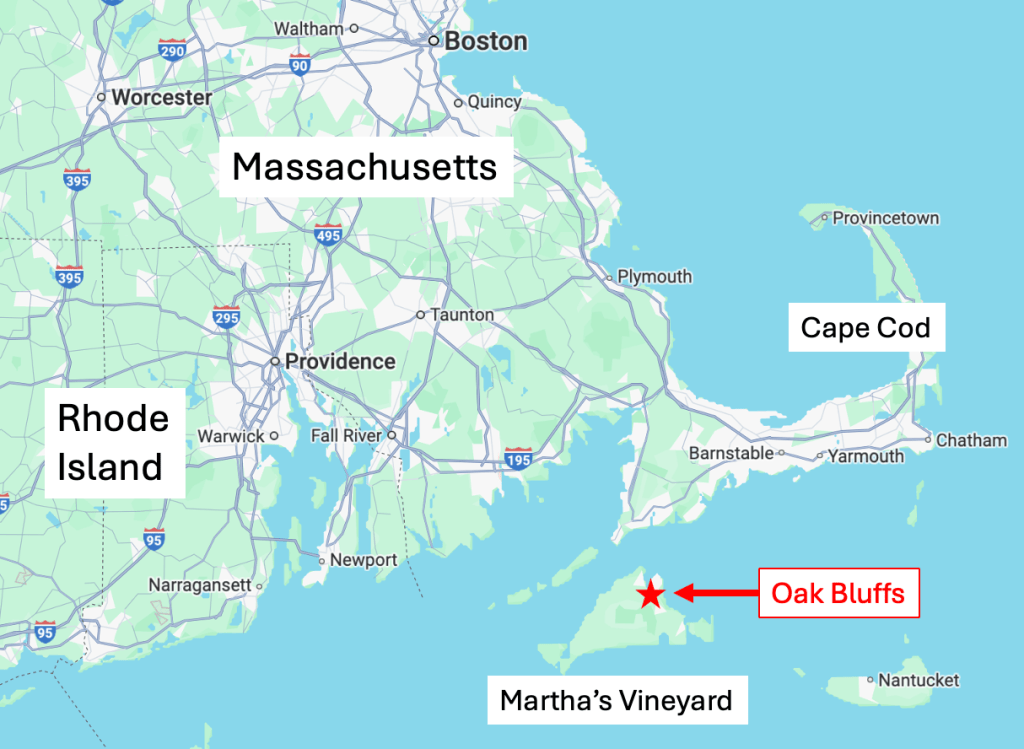

Where is the Town of Oak Bluffs?

The Town of Oak Bluffs is located on the northeast coast of Martha’s Vineyard. It is known best as a summer destination for tourists, with its colorful Victorian “gingerbread” cottages, historic Flying Horses Carousel, and many attractions including its harbor, beaches, shops, and restaurants (LINK to more on Oak Bluffs).

And What About the Property in Question?

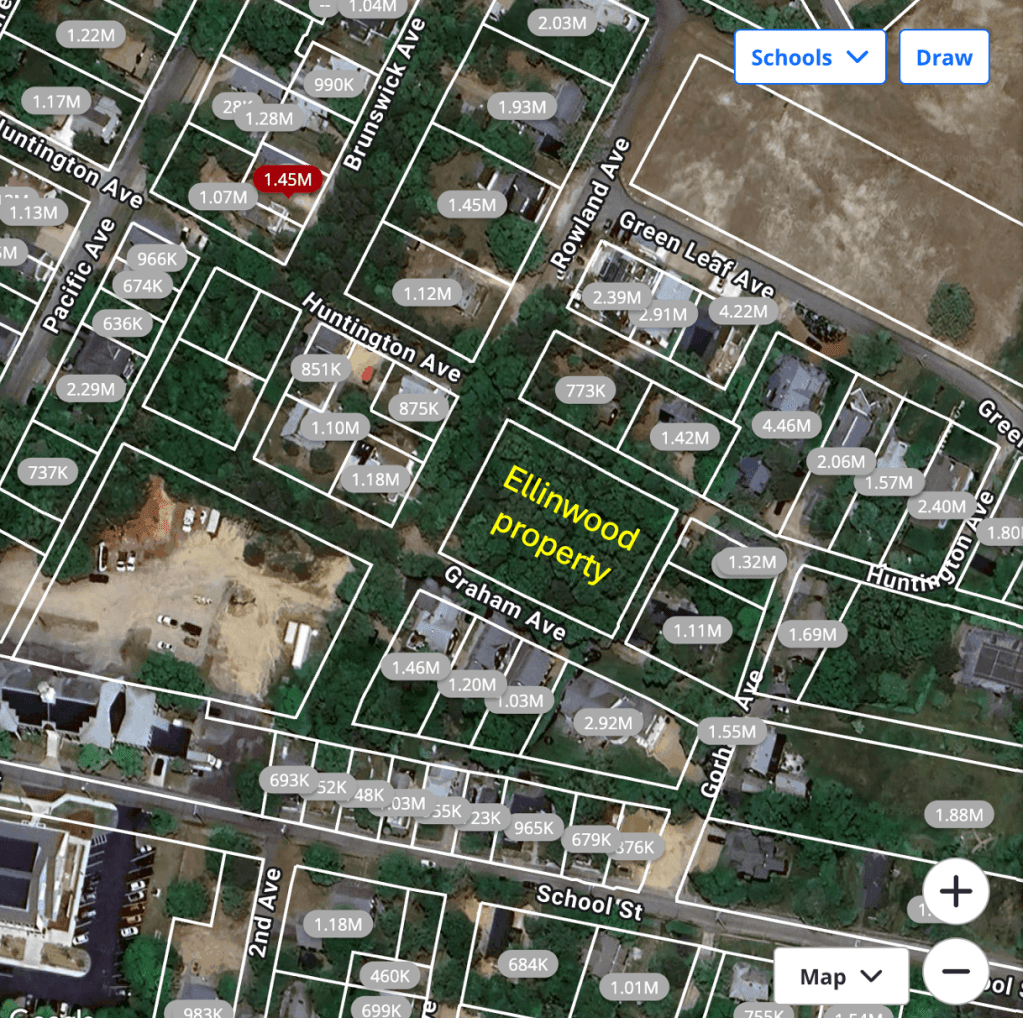

Apparently, the property in question had been used as a public park for many years. Located at the southeast corner of Rowland and Huntington Avenues, it is located at the red mark in the map below, and listed as Lot 255 on Assessors’ Map 8, described in Dukes Deeds, B. 66, P. 499, and Dukes Probate D3/218.

And it’s quite large compared to the other residential lots in that neighborhood. At 0.58 acres, it’s about half the size of a football field. We were told by the town clerk that the assessed value of the property was about $45,000. But by early 2000, about $6,000 was already owed in back taxes.

Why Now?

Despite several attempts in writing and on the phone, I was unable to find out why the town decided to start taxing the property and start a foreclose process. Maybe they discovered that the town did not have title to the property during a routine check for titles? Or maybe someone wanted to buy or develop the property?

Regardless of the reason, some time in the mid-1990s, the town discovered that the property was still owned by the heirs of Truman J. Ellinwood. So they hired the Boston law firm of Coppola and Coppola, specializing in Municipal Tax Collections.

The town started to tax the property in the late 1990s, and since none of the heirs knew about the property, these taxes would go unpaid. Therefore, the town started the foreclosure process a few years later.

But before they could complete the foreclosure, the law required them to contact all the heirs of the property. And that’s why several of my mom’s relatives had gotten letters from the law firm of Copolla and Copolla.

Finding the Heirs

Clearly more research was needed. My interest in genealogy began in 1969, as an assignment in my history class. And over the next three decades I had been collecting information about my ancestors, including an extensive record of all our Stone and Ellinwood relatives.

So who were the surviving heirs of Truman’s property? He left his property to his four siblings, or their children if they had already passed:

- His half-brother, Ira O. Ellinwood. I discovered that he had three surviving great-grandchildren;

- The four children of his predeceased sister Pamela C. Stone:

- Willis Stone of Chicago. He had no heirs,

- James A. Stone of Reedsburg, WI. My great-grandfather, he had six surviving grandchildren and 14 great-grandchildren,

- Lincoln O. Stone of Cresbard, SD. He had three surviving grandchildren and 15 great-grandchildren, and

- Mina S. Gabriel of Denver, CO. She had no heirs;

- The children of his predeceased sister Mina (Nina F.) Porter. She had no surviving heirs; and

- The children of his predeceased sister-in-law Eunice C. Denio. She had no surviving heirs.

So after considerable searching of my ancestry records, I had discovered about 40 living heirs to this property. With the estimates provided to me by the clerk at the Town of Oak Bluff of a property value of about $42,000–and a tax liability of about $6,000–the net worth of the estate was about $36,000.

However, it was much more complicated than simply dividing the net value of the property by the number of surviving heirs. First, the property was to be divided equally among the four Ellinwood siblings. However, since only two of them had any surviving heirs, Ira’s three heirs would split his 50% share (about $6,000 each). In contrast, because my mom was one about 37 surviving heirs of Pamela, she would only get about $650. And the children of her siblings who had passed away would split that amount equally among their siblings–each ending up with about $100 each.

What to Do–Pay the Taxes or Let the Town Foreclose on the Property?

With this information in hand, I reached out to as many relatives I could contact and asked for advice. My brother Mike–who was an attorney at a large Washington DC law firm–reminded me that it was not as simple as it may seem. We would have to hire a lawyer in Massachusetts to determine how the 40 or more heirs would collectively own this property, at a legal cost that could easily exceed the value of the property. And not to mention how we’d fair, fighting the town board who wanted to foreclose on the property and take ownership.

In the end, we did nothing. More than a year passed, and then the heirs were notified of the publication of the final petition to foreclose in the Vineyard Gazette on November 19, 2001:

The petition stated, “Whereas, this petition has been presented to said Court by the Town of Oak Bluffs in the County of Dukes County, and the Commonwealth of Massachusetts, to foreclose all rights of redemption from the tax lien proceedings described in said petitions...in said Oak Bluffs on Rowland Ave…”

“If you desire to make any objection or defense to said complaint you or your attorney must file a written appearance and an answer, under oath, setting forth clearly and specifically your objections or defense to each part of said petition, in the office of the Recorder of said Court in Boston (at the Edward W. Brooke Courthouse), on or before the fourteenth day of January next.“

January 14, 2002 came and went and the Town of Oak Bluffs took possession of our property.

AFTERWORD (November 2025)

While writing this story, I decided to check up on the status of our property, now almost 25 years later. The first thing I noticed is how much more information can be garnered online, including: Truman J. Ellinwood’s actual will (LINK to will), Google Maps (though Street View does not work) (LINK to Google Map), the Town of Oak Bluffs assessors records (LINK to property value), and finally Zillow showing adjacent property values (LINK to Zillow):

I was surprised to learn that the property has increased in value from only $42,000 in 2000 to $618,300 in 2025. And it is surrounded by residential lots valued in the millions of dollars!

I wonder aloud now, should we have paid those back taxes and figured out a way to form a partnership of owners? Why was the assessed value so low in 2000? Is it too late to file an appeal?

Oh well, maybe it’s time to go for a visit to see what could have been our summer place on Martha’s Vineyard.

Leave a reply to Anonymous Cancel reply